Chargeback is a neat feature large payment processors such as MasterCard and VISA introduced as a convenient measure that would help resolve billing disputes or assist victims of online theft.

A chargeback dispute usually occurs between a merchant and a credit/debit card issuing bank or consumer (i.g. in case of an ATM deposit mistake). Of all the chargeback services, the primary purpose is to reverse a payment that was a result of a billing error and/or unauthorized card usage.

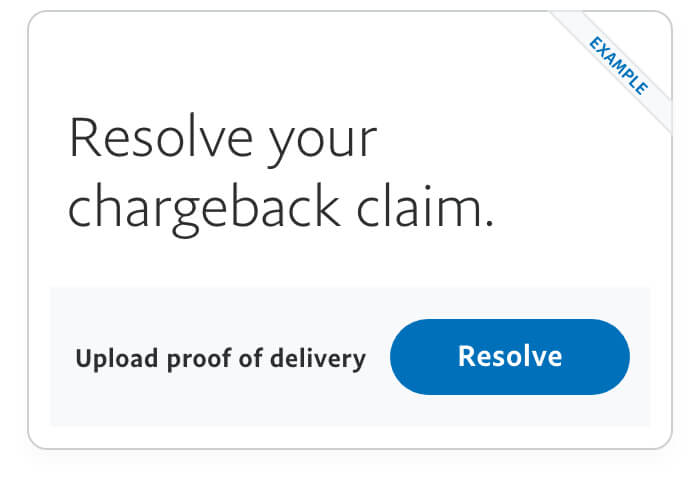

Although the procedure typically starts when a cardholder disputes a payment with their bank, merchants can contest the chargeback. This can lead to a dispute between their banks and potentially drag card networks into the adjudication process, i.e. it becomes a mess.

Hence, it is crucial to get familiar with the rules and nuances regarding the chargeback process to make sure the process is successful. Our article explains how to request a chargeback, how the process works, and lists some common mistakes and misconceptions.

Analyzing the Chargeback Procedure Step by Step

To request a chargeback, you have to contact your bank and present the dispute. You can start by reviewing your credit/debit card statement and determine the exact transaction you wish to dispute.

Once that’s done, contact your issuing bank’s customer service and inform them about the problematic transaction. Explain why you want to reverse it while providing unambiguous details such as the date of the transaction, the payment amount, and a justified reasoning for why the payment should be undone.

The bank will then analyze your case and may require additional documents such as receipts, invoices, emails, or any relevant communication with the merchant. To ensure that you are eligible for a credit card chargeback, make sure you’re filing the dispute within the prescribed deadline.

If successful, the bank will deem the dispute valid and refund the amount to your credit card. That’s how to get chargeback from bank. Just bear in mind that the success of a chargeback depends on how strong your case is and whether you can prove to the bank that the dispute is justified.

When To Request a Chargeback?

There are several instances when you should request a chargeback. These include common scenarios such as not receiving the purchased item or receiving something faulty or drastically different from what you ordered. Either that or if you bought something by mistake.

The first thing you should do is contact the seller and inform him about the issue. Should your refund request be rejected, initiating a chargeback may be the best solution.

Another scenario is if you have evidence of unauthorized or fraudulent transactions on your card. Ensure that the evidence aligns with the criteria accepted by the card issuer for a chargeback. MasterCard provided lengthy guidelines for how to get chargeback on debit card or credit card.

PayPal Chargeback

Aside from credit and debit cards, large electronic wallets such as PayPal also allow for a chargeback, governed by the company’s rules. The rules we outlined in the previous section also apply here.

If you did not receive the right item, if the product is damaged, or if you suspect fraudulent activity, you can request a PayPal chargeback.

Time Limits for Requesting a Chargeback

VISA and MasterCard have prescribed time limits for their chargeback rules. For the former, cardholders have a 120-day window to dispute a charge, starting from the transaction processing day. Some specific issues can be disputed within 75 days only.

Merchants who are liable to respond to a VISA chargeback have 30 days to submit representation. In the case of arbitration, a 10-day deadline applies.

On the other hand, MasterCard stipulates 120 days for most chargeback services and a 45-day limit for certain issues. Merchants dealing with MasterCard chargebacks must respond within 45 days at each stage. Additionally, the payment processor may request additional information before moving forward with the dispute.

Chargeback Fraud

To recap, chargebacks are used to undo genuine billing mistakes. However, over the last couple of years, the rapid expansion of online commerce has led to a rise in chargeback abuse, commonly referred to as “friendly fraud”.

A chargeback fraud occurs when a consumer purchases something online using their credit card and then requests a chargeback from the issuing bank after receiving the purchased goods or services. That way, he gets both the product and a refund.

Conclusion

To sum things up, we shall once again outline our main points. Understanding how the chargeback works is key to making the process flow effectively. While the refund system serves as a valuable tool for billing errors and combating fraudulent practices, consumers should approach the process ethically with good reasoning.

Individuals should contact their card issuer, providing detailed information about the transaction they wish to dispute while following the predetermined timeframes set by the card company. The chargeback can be used to reverse both credit and debit card transactions, as well as PayPal and other e-wallet payments.

I Need Help With the Chargeback

If you cannot figure out the chargeback process or need assistance throughout the procedure, you can contact a chargeback company for help. Reclaim Block features a team of experts who deal with chargebacks on a daily basis and boast a large resume of successful cases.

They can surely assist you with the chargeback and help you get your money back, especially if you are a victim of cyber fraud. Book a consultation with our experts and tell us about your issues. Together, we can analyze your case and help you recover your funds.

FAQ Section

What’s a chargeback?

A chargeback is the process of reversing credit/debit card transactions. The procedure can be initiated at the issuing bank.

When to request a chargeback?

You should consider requesting a chargeback in case you don’t receive the product or service you purchased, you made an error payment or fell victim to fraud.

Does PayPal allow a chargeback?

Yes, PayPal has a chargeback option. It’s similar to MasterCard and VISA’s procedures but is governed by PayPal’s rules.

Source:

https%3A%2F%2Fscambrokersreviews.com%2Fwealth-insights%2Fhow-to-request-a-chargeback-key-facts-you-should-know%2F

Leave a Reply